FSA/HSA Eligibility

Checking out with Truemed is easy!

Checkout

Find the Truemed logo during checkout. Exit the "Shop Pay" pop-up if prompted.

Complete Health Assessment

Take a quick, private health survey. A licensed provider will review your answers to determine eligibility.

Make your purchase

Pay with your HSA/FSA card or a credit card. If you use a regular credit card, follow the guide included with your LMN to submit your purchase for reimbursement.

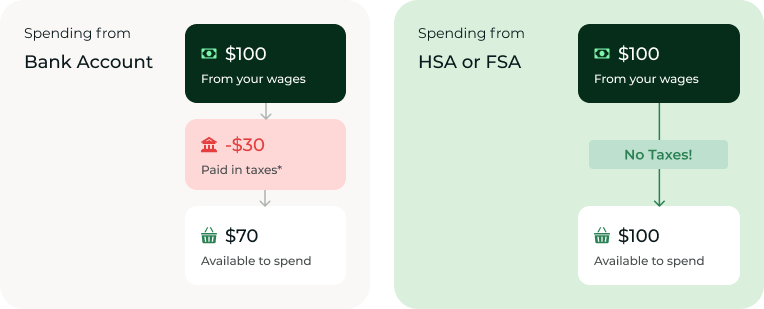

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Who is Truemed?

At Truemed, we believe that investing in your health is far more valuable than waiting to spend on sickness. By unlocking pre-tax HSA/FSA spend on research backed interventions such as fitness, supplements, and health technology, we’re shifting healthcare spend toward true medicine.

Frequently Asked Questions

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

Yes. When you use your regular credit card, Truemed will send you instructions on how to submit for reimbursement from your HSA/FSA administrator.

Mattresses aren’t typically eligible within FSA/HSA plans, unless a healthcare professional deems it as medically necessary based on certain health conditions. A “Letter of Medical Necessity” (LMN) is required in these cases.

We’re proud to partner with Truemed, a third-party company that facilitates these LMNs with healthcare professionals so that you can use your funds!

There is no cost incurred by you when purchasing from a Truemed Partner Merchant. Twinkle Beds is proud to be recognized as an official Truemed partner.

An LMN, or Letter of Medical Necessity, is like a doctor’s note. It’s issued by a healthcare provider to outline the medical reasons why a particular product or service is medically necessary for an individual's health, and qualifies your purchase to be HSA/FSA eligible. LMNs demonstrate that an expense is needed to diagnose, treat or alleviate a medical symptom, rather than for general health or wellness purposes.

You can request a Letter of Medical Necessity through our partner, Trumed. If you’re approved, you’ll be able to check out using your FSA/HSA funds for your qualified purchase.

To request an LMN to purchase Twinkle Beds products, you will:

- Complete an intake form, similar to how you would at a doctor’s office

- Chat with a certified healthcare provider via text message for further evaluation

Once you have your LMN in hand, you can return to Twinkle Beds and shop as usual. During checkout, you’ll simply select the Truemed method to use your HSA/FSA funds.

If you want to use your FSA/HSA funds to purchase Twinkle Beds products, you’ll need a Letter of Medical Necessity (LMN). We’ve partnered with Truemed to help you with this!

Certain products are eligible for purchase with FSA/HSA funds if they treat, cure, prevent, diagnose or alleviate a medical need. For instance, items like bandaids are always eligible as they serve a solely medical purpose.

However, there are “dual-eligible” products that can be used for general health and wellness or for specific medical purposes—if recommended by a healthcare provider based on your individual needs. Take iron supplements, for example; many use them to support their overall health. Yet, for someone with anemia, iron supplements become crucial. In such cases, individuals can use their FSA/HSA funds if their healthcare provider issues an LMN, recommending the supplements specifically to address their anemia.

Health conditions that may qualify for a Letter of Medical Necessity(LMN) for the purchase of Twinkle Products:

- Daytime fatigue or excessive drowsiness

- Chronic difficulty in sleeping or insomnia

- Musculoskeletal pain, stiffness or discomfort

- Sleep apnea or snoring

- Other respiratory related sleep disturbances

To see if you’re a candidate for a Letter of Medical Necessity, Truemed's healthcare team will need some basic information from you. Similar to other telehealth experiences, you’ll be asked to share your name, contact information, date of birth, information about the symptoms you are experiencing, and your medical history. We will also verify your phone number and ask you to upload a photo ID to verify your identity. This pre-qualification process takes about 3 minutes.

Generally it takes 24-48 hours. In some cases, Truemed’s provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

Letters of Medical Necessity are valid for 12 months from the day they are signed and written.

The information you provide in the LMN process will be kept confidential and shared only with Sika’s healthcare providers to evaluate your eligibility for an LMN. For more information, see Truemed's Privacy Policy.

If you would prefer to use your own credit card at checkout, you’ll need to submit your receipt and a copy of your LMN to your plan for reimbursement.

To do this:

- Log into your FSA/HSA account on your benefit administrator’s website

- Find the Reimbursement or Claims section

- Upload your receipt and Letter of Medical Necessity

Your administrator will process and evaluate your claim. Please note that some FSA/HSA benefits administrators may incorrectly deny reimbursement, so before purchasing a product with an LMN you should consider contacting your administrator to determine if your purchases will be covered/reimbursed.

If you are having trouble locating your itemized receipt or LMN, please contact support@truemed.com

No problem! Truemed can check your balance and use that amount, and then you can put the remaining amount on a credit card or debit card.

Trumed's independent healthcare provider may determine that you do not have symptoms demonstrating a medical necessity for a product or service. While you cannot use your FSA/HSA funds now, you can still use another payment method to complete your purchase. We do not recommend reapplying.